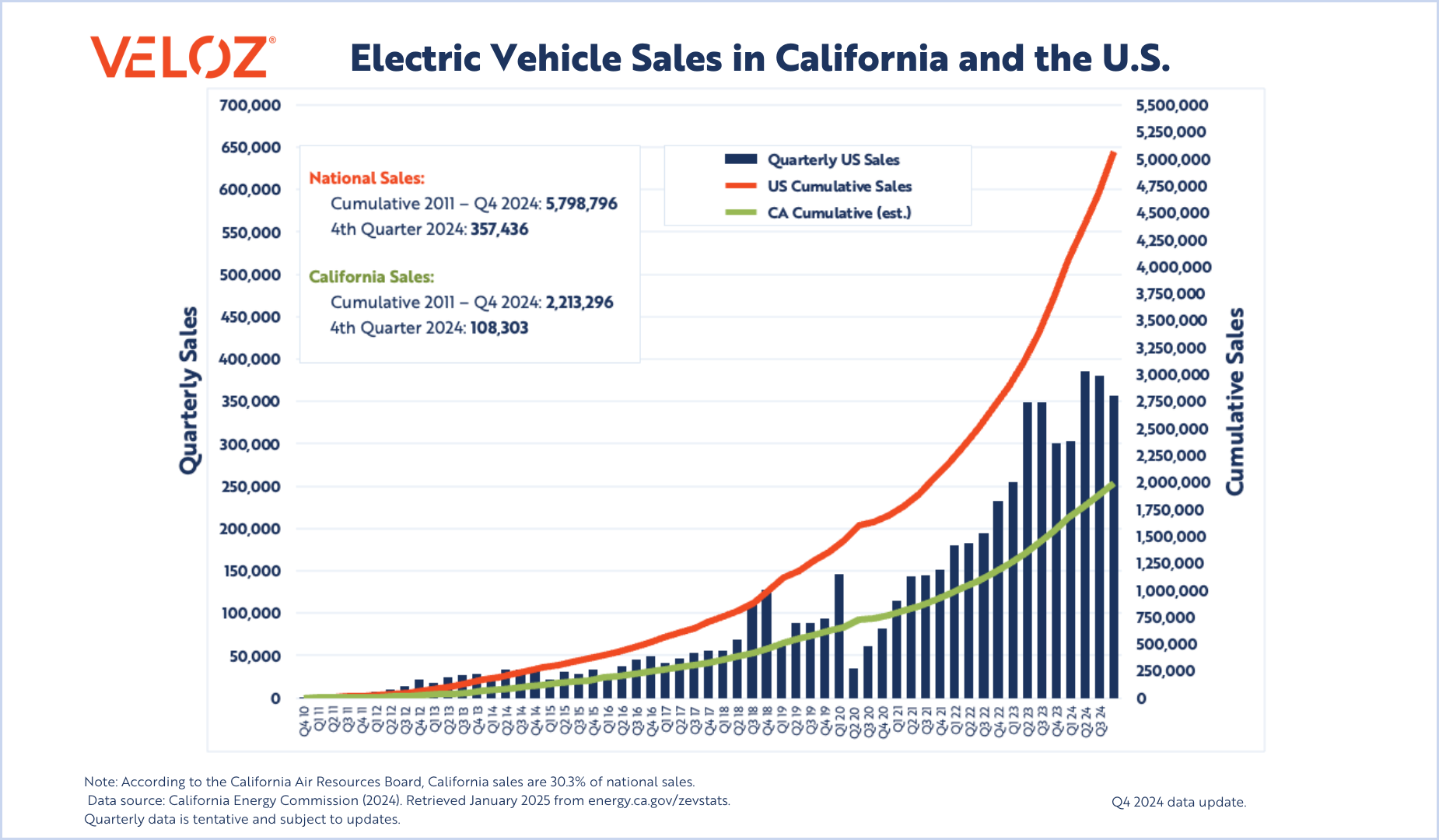

Q4 2024 New EV Sales Helped the State Reach Over 2.2 Million New EVs Sold

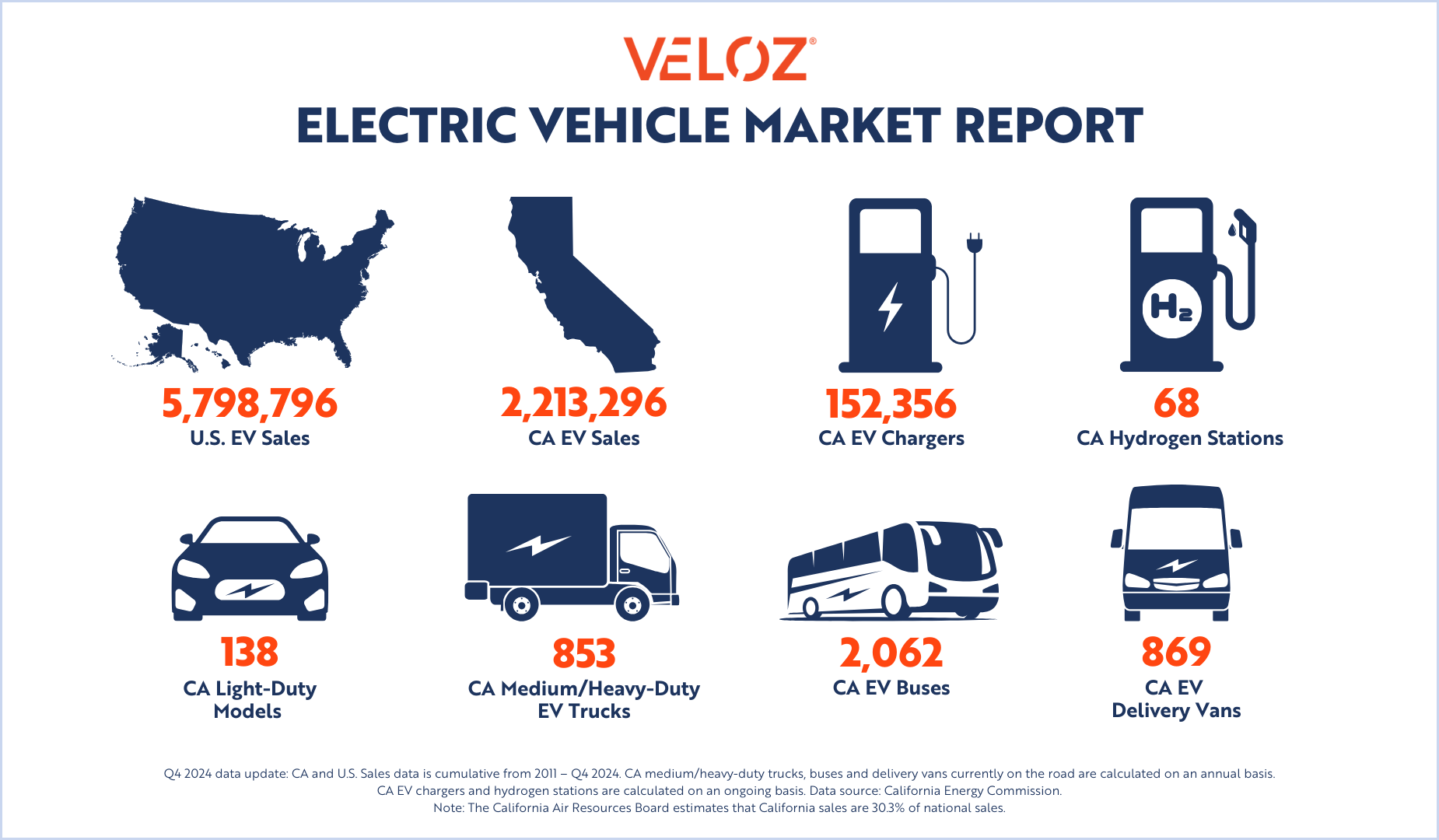

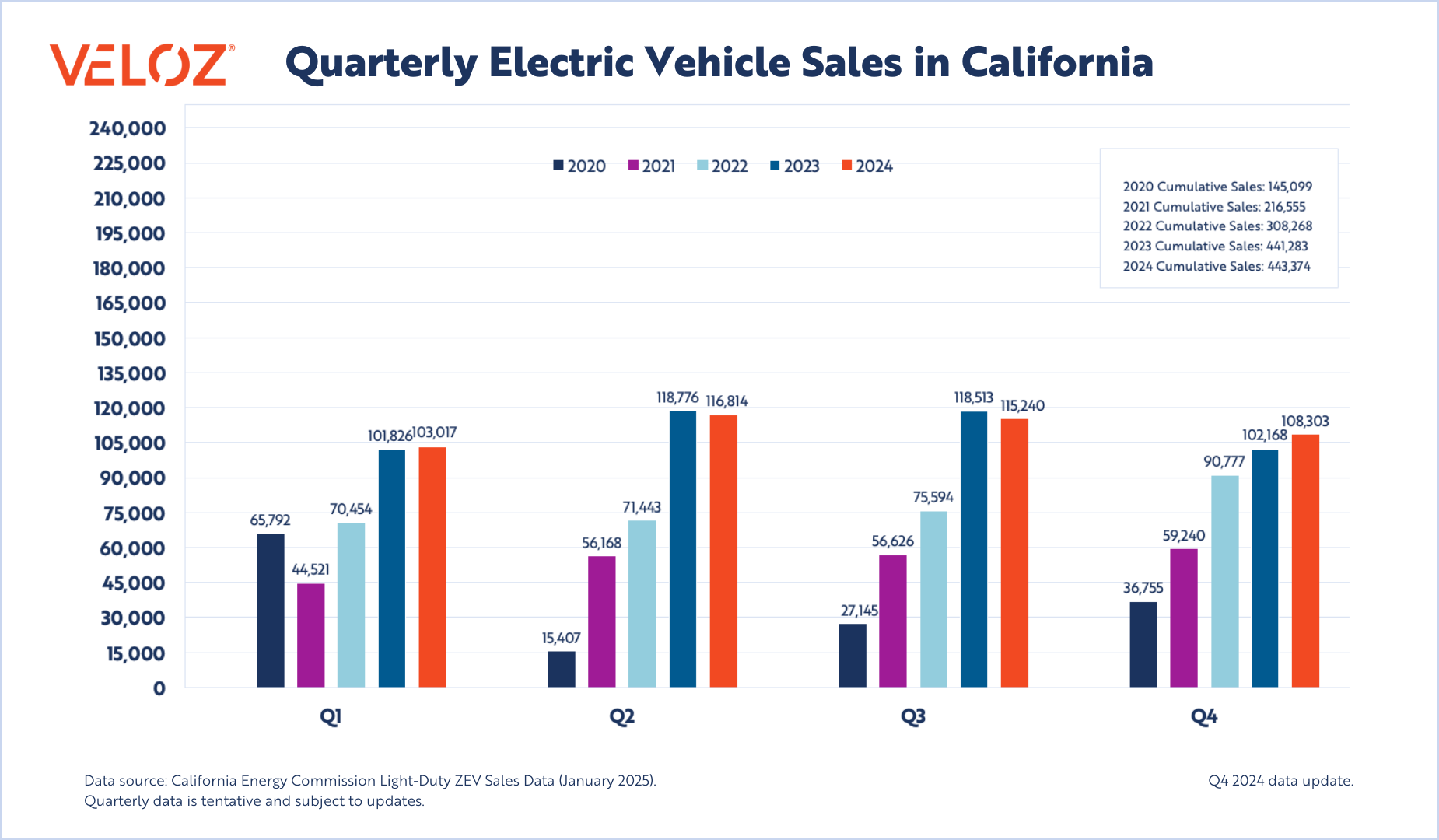

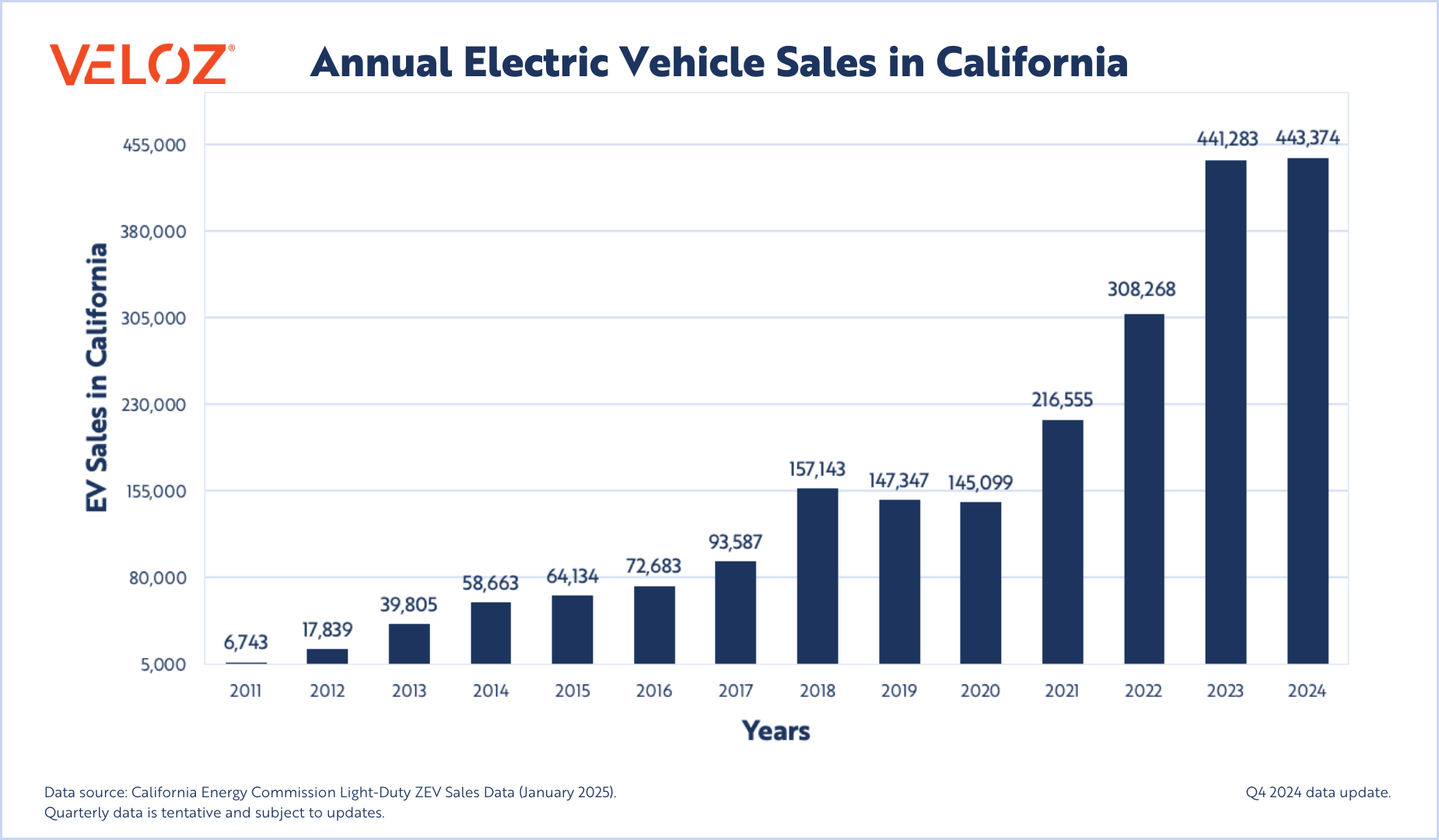

California closed 2024 on a high note in Q4 with 108,303 new EV sales — an increase of 6% over Q4 2023 sales. The state also surpassed 2.2 million cumulative new EV sales in Q4 2024, recording 2,213,296 million EVs sold by the end of the year, up from 1,769,922 in 2023. This marks 443,374 new EVs sold in 2024, a slight increase from the 441,283 sold in 2023. California’s increase in Q4 mirrors many automaker announcements of record-breaking EV sales across the nation at the end of the year. A recent Veloz poll indicates that consumers across the nation support government incentives for EV purchases and, while multiple factors influence market trends, the threat of a possible shift in federal policies and incentives may have contributed to record sales in the fourth quarter.

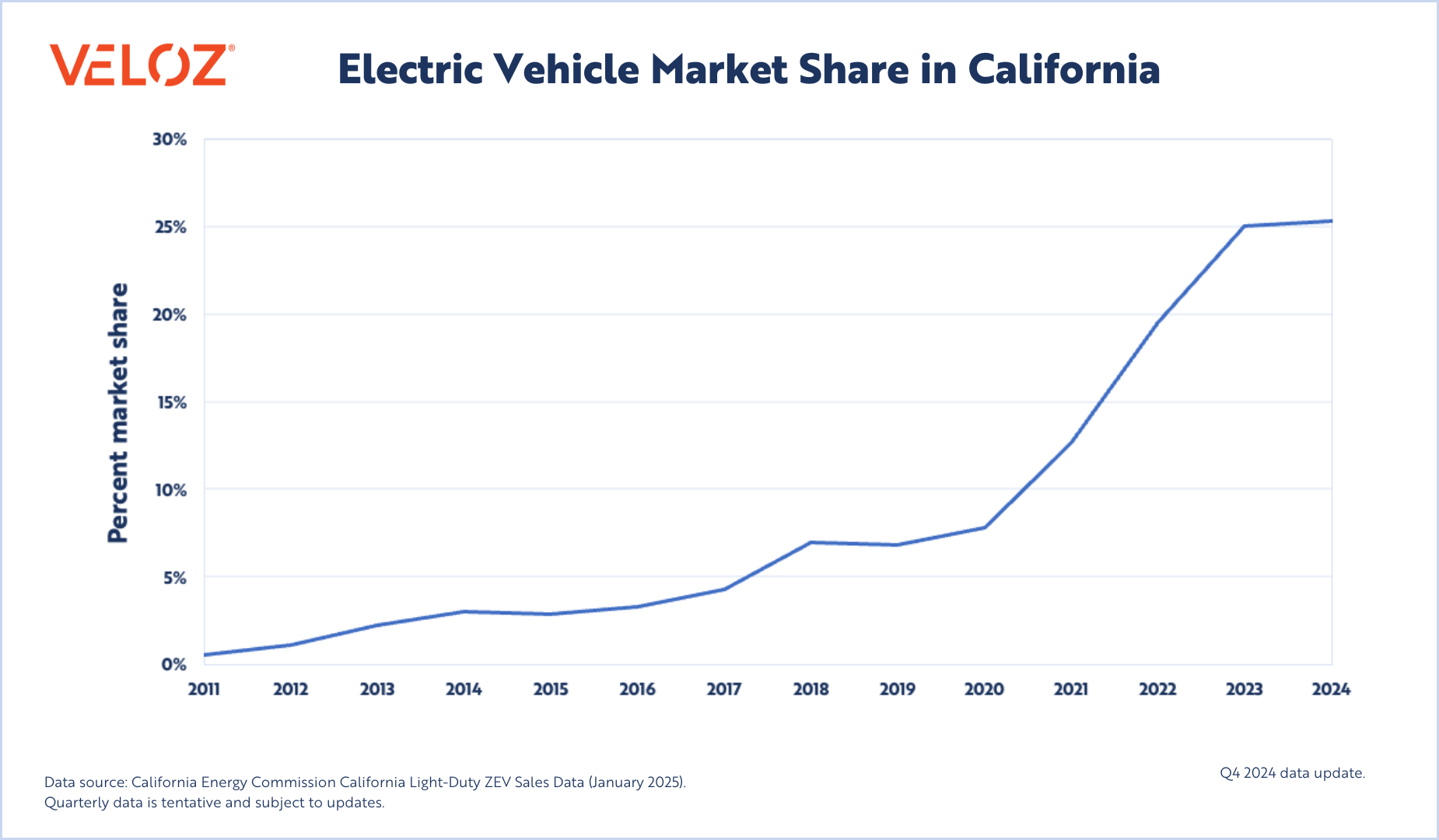

While EV adoption continues to grow, the pace has steadied as the market shifts from early adopters to a more stable, mainstream phase. Consumer interest, coupled with expanding infrastructure investments, continues to make the transition to EVs accessible to more individuals. California’s annual EV market share increased from 25% in 2023 to 25.31% in 2024, reinforcing the state’s national leadership in clean mobility. The final quarter of 2024 highlighted two key pillars shaping the EV market’s ongoing expansion: strong EV sales and major infrastructure investments.

Automakers Report Significant New EV Sales Numbers

Nationally, new EV sales experienced significant growth in the fourth quarter of 2024, with several automakers reporting record-breaking figures. General Motors (GM) reported its best ever EV sales with a 50% year-over-year increase in annual EV sales, totaling 114,432 units, with a Q4 year-over-year growth of 125%, totaling 43,982 units. The Chevrolet Equinox EV led this surge with 18,089 deliveries, while the Blazer EV and Hummer EV saw 7,883 and 5,091 units sold, respectively.

Ford also achieved record EV sales in Q4 2024, with 30,176 units sold, marking a 16% year-over-year increase. The Mustang Mach-E had its best quarter to date, with 16,119 units sold, contributing to a total of 51,745 units in 2024—a 27% increase from the previous year. The F-150 Lightning also saw significant growth, with 33,510 units sold in 2024, up 39% from the prior year. These milestones were supported by initiatives like the Ford Power Promise, which offers complimentary home chargers and standard installation to enhance the EV ownership experience.

In addition to GM and Ford, other automakers experienced notable success in Q4 2024. Rivian reported delivering 14,183 vehicles in Q4, surpassing their quarterly delivery expectations and reflecting growing consumer interest in their electric trucks and SUVs.

Hyundai reported record-breaking sales in December, with total deliveries increasing by 4% year-over-year, the highest December sales total in the company’s history. Hyundai’s IONIQ 5 set a Q4 total sales record, contributing to a 64% increase in the company’s electrified vehicle sales compared to Q4 2023.

Honda launched their first all-electric SUV — the Prologue — in March 2024 and it quickly became the seventh best-selling EV in the U.S. in 2024 and the fourth best-selling EV in California in Q4 2024. With over 33,000 units sold in the U.S. in 2024, the Prologue’s swift adoption highlights how expanding consumer choice is driving EV sales and accelerating market growth.

Top 10 Selling EVs in California — Q4 2024

- Tesla Model Y

- Tesla Model 3

- Hyundai IONIQ 5

- Honda Prologue

- Chevrolet Equinox EV

- Ford Mustang Mach-E

- Tesla Cybertruck

- Rivian R1S

- Toyota bZ4X/Solterra

- Mercedes EQE

Major Infrastructure Progress and Investments

Charging infrastructure investments were a defining theme of Q4, with notable progress made under the National Electric Vehicle Infrastructure (NEVI) program, which is accelerating the deployment of high-speed chargers along key transportation corridors. In Q3 2024, California announced the first notice of proposed awards across six corridor groups, totaling $37.7 million in public funding matched by $53.2 million in private sector investment.

Nationally, over 82,000 miles of NEVI-eligible EV charging corridors have been designated as of October 2024, with $885 million allocated for charger deployment in 2024 alone. Further, in January 2025, the Biden-Harris Administration awarded $635 million to fund 49 projects, that will deploy over 11,500 EV charging ports nationwide.

While federal investments like the NEVI program have accelerated public EV charging expansion, California is leading the way with a $2.9 billion investment from the California Energy Commission (CEC). This funding—one of the largest in the country—will deploy tens of thousands of new chargers, expand hydrogen refueling, and improve accessibility for underserved communities. With more than 152,000 public chargers currently available and an additional 17,000 planned, this investment ensures that infrastructure keeps pace with rising EV adoption—now surpassing 2.2 million new EV sales statewide. By prioritizing reliability and equitable access, particularly for multi-unit dwellings and disadvantaged communities, California continues to set a national precedent for public-private collaboration in charging deployment.

Looking Ahead: A Strong Foundation for 2025

As 2024 came to a close, key market indicators signaled sustained consumer confidence, record EV adoption, and expanding infrastructure—both in California and across the nation. Looking ahead to 2025, continued collaboration between policymakers and automakers will be crucial—not only in expanding charging access but also in accelerating consumer adoption. Maintaining and expanding state and federal EV incentives will help ensure that EVs remain financially accessible to a broader range of consumers. These incentives, along with the introduction of new affordable EV models, will further drive adoption.

EV policy plays a key role in adoption—shaping both consumer confidence and industry investment. To explore how policy decisions impact the future of electrification, attend Veloz’s next Digital Dialogue, EV Policy: Working Under a New Administration.

For media inquiries, please contact Margaret Mohr, Veloz Communications Director, at margaret.mohr@veloz.org.