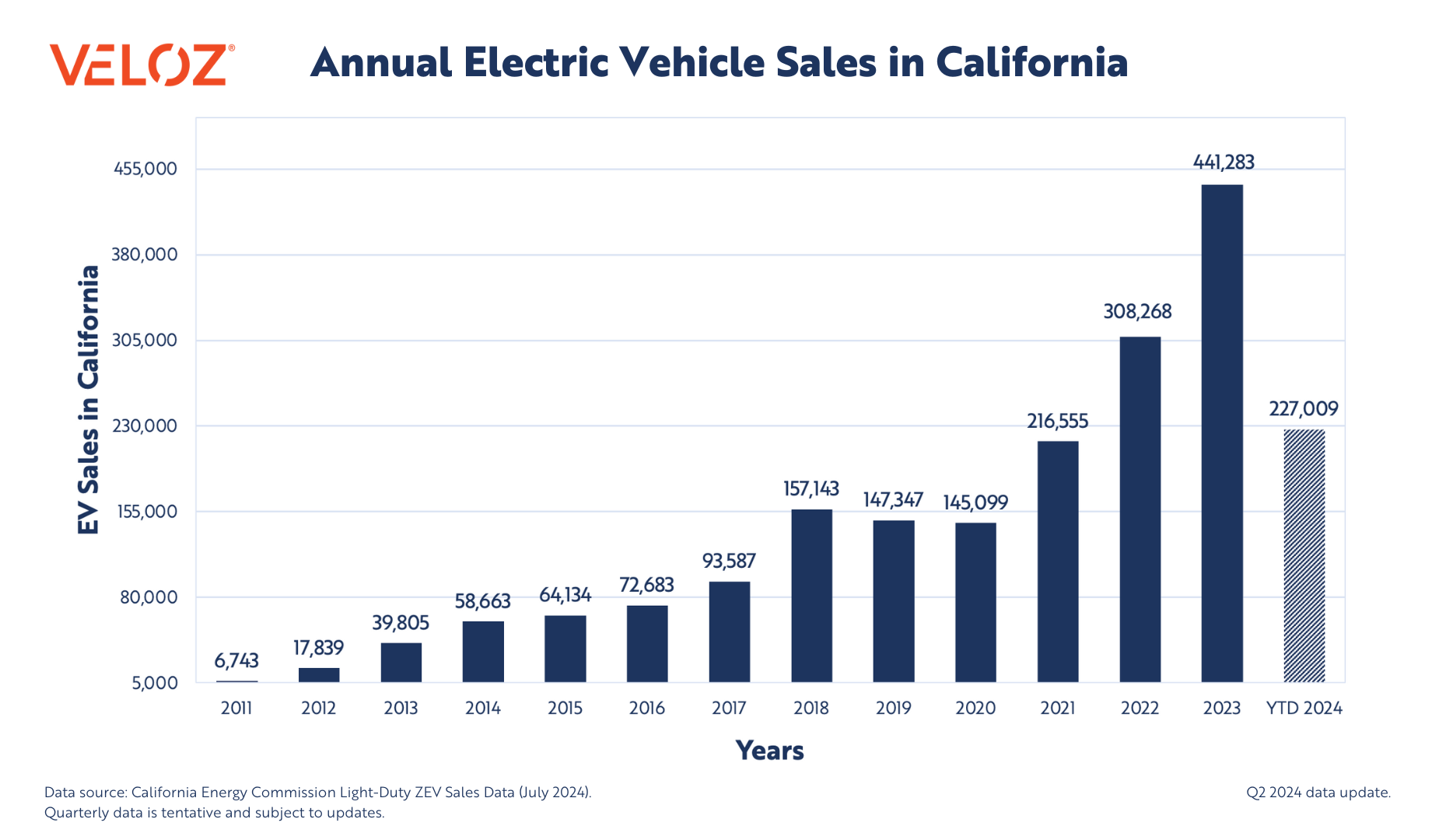

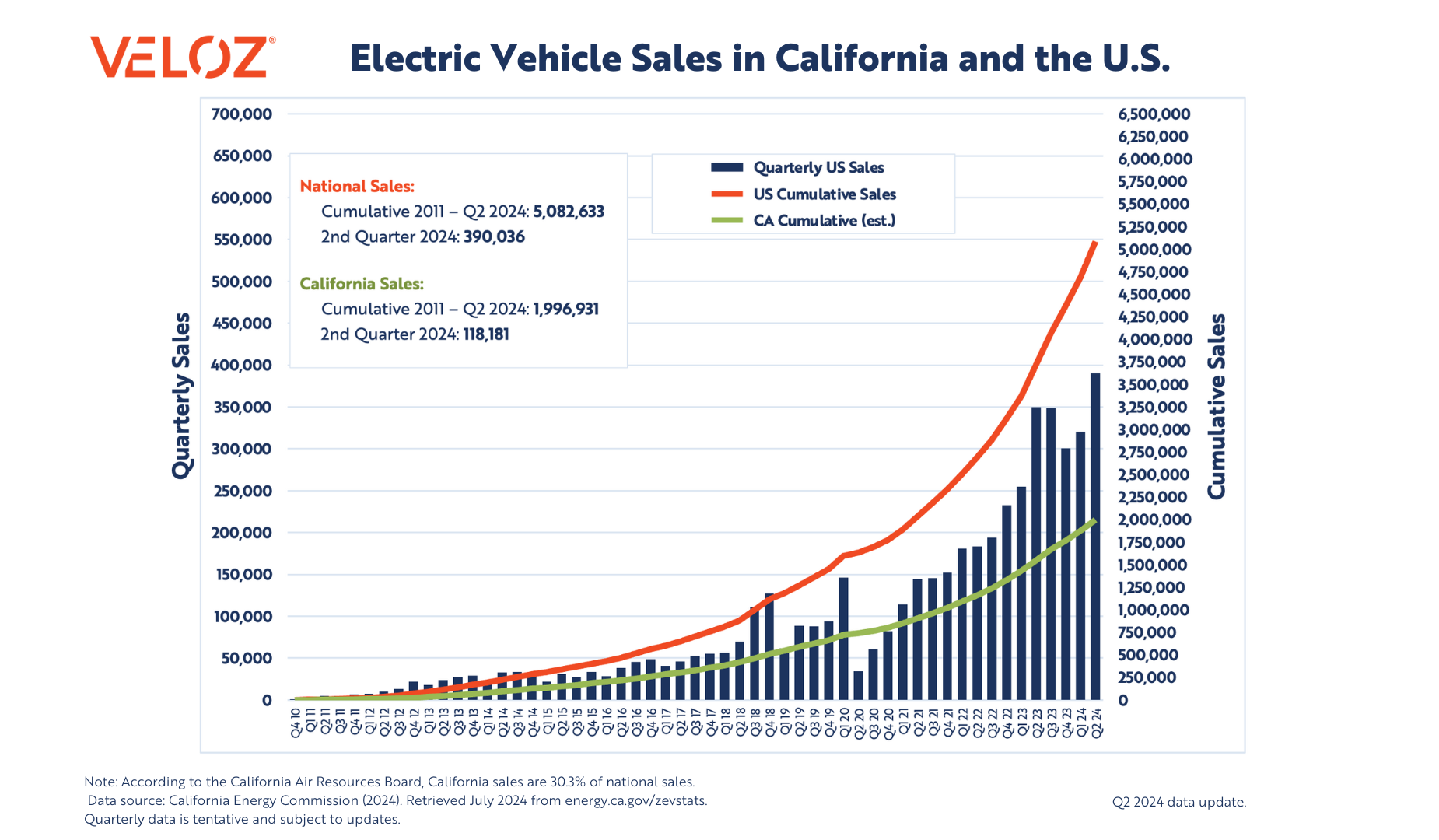

New EV sales in the state are headed toward the 2 million sold milestone

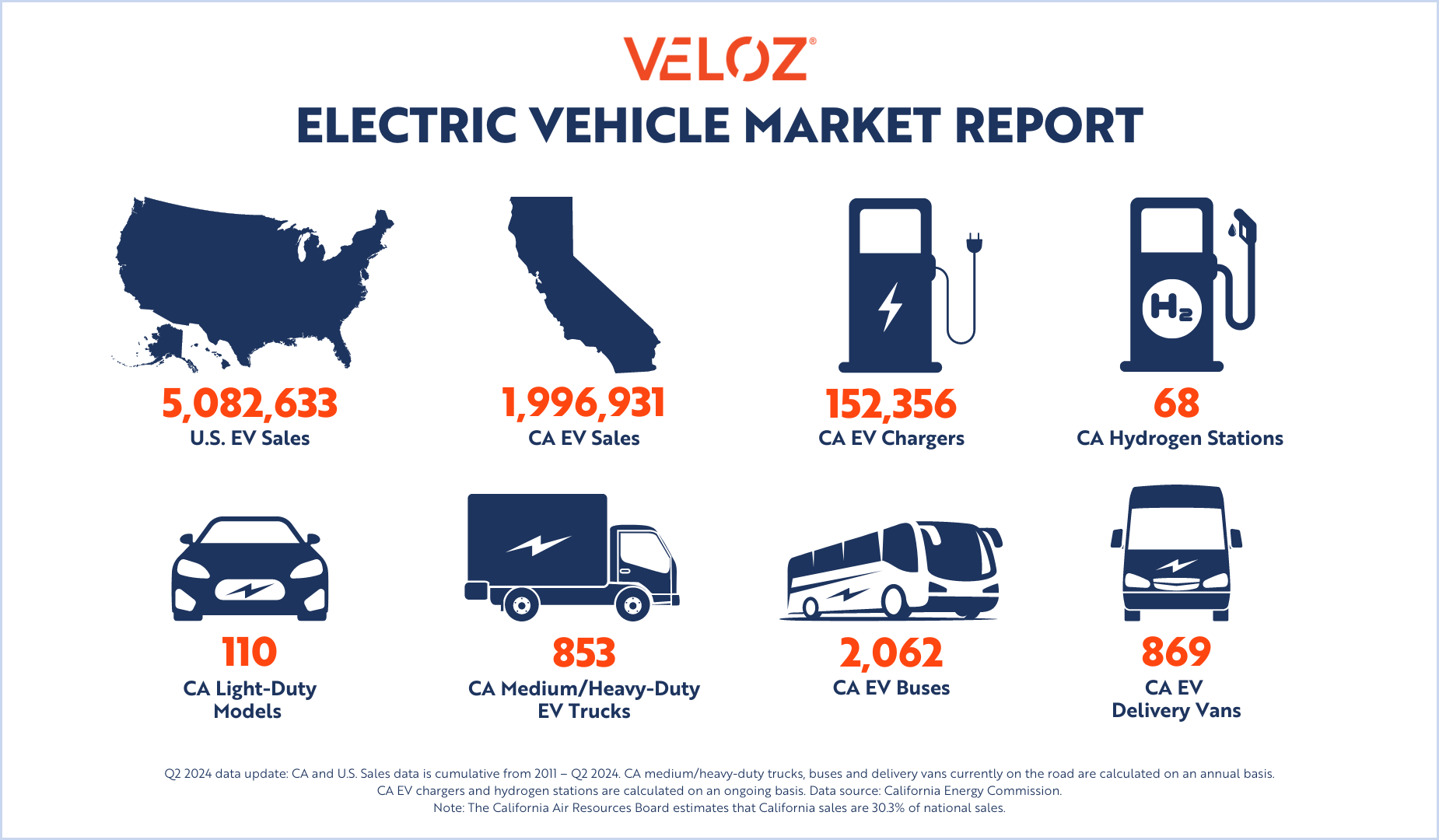

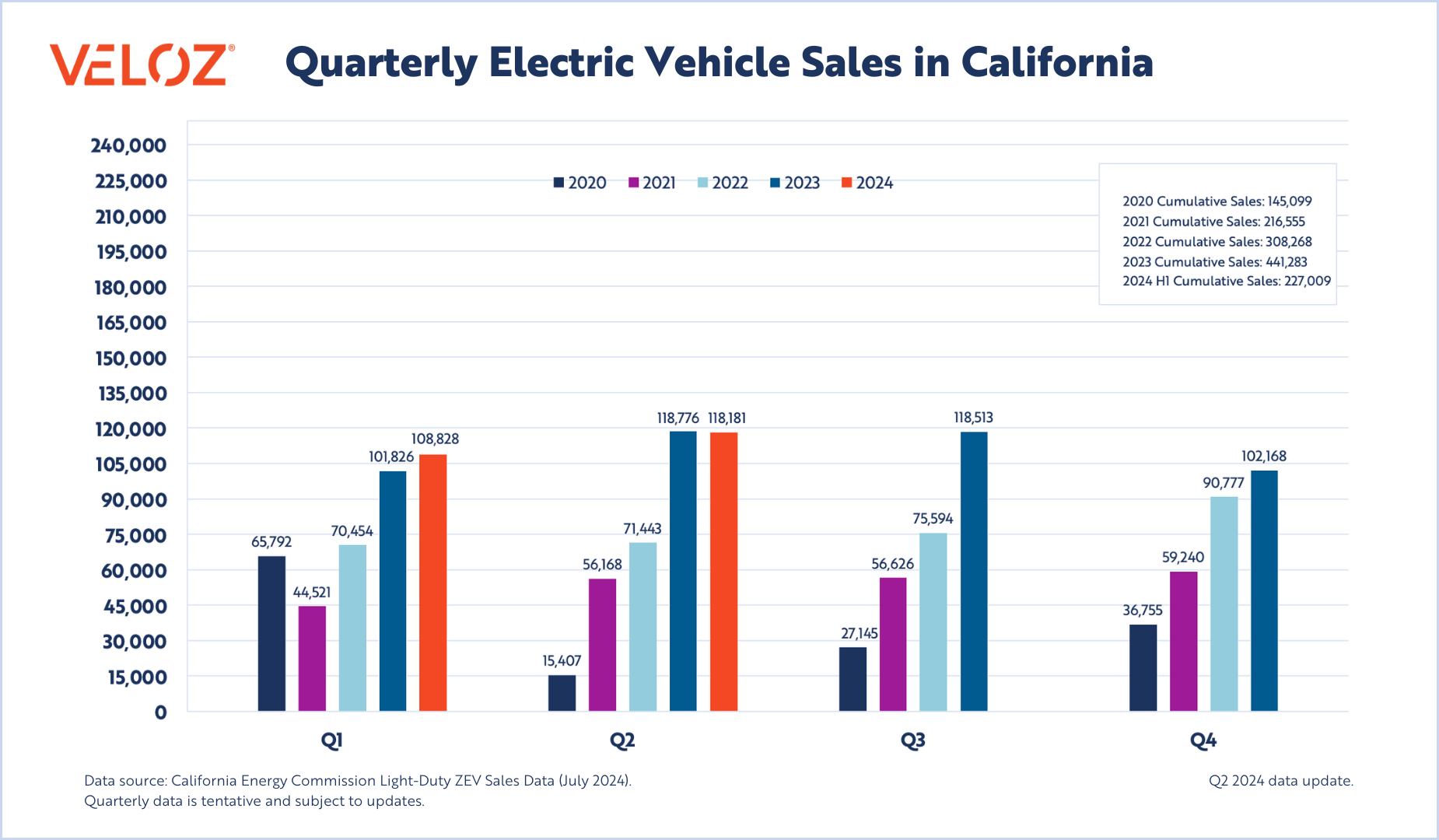

Veloz’s Q2 2024 EV Market Report is now available, revealing continued growth in new light-duty passenger EV sales, according to data from the California Energy Commission (CEC) and the California Air Resources Board (CARB). In Q2 2024, 10,000 more new EVs were sold compared to Q1 2024, making it the third-highest quarterly sales total in recent history.

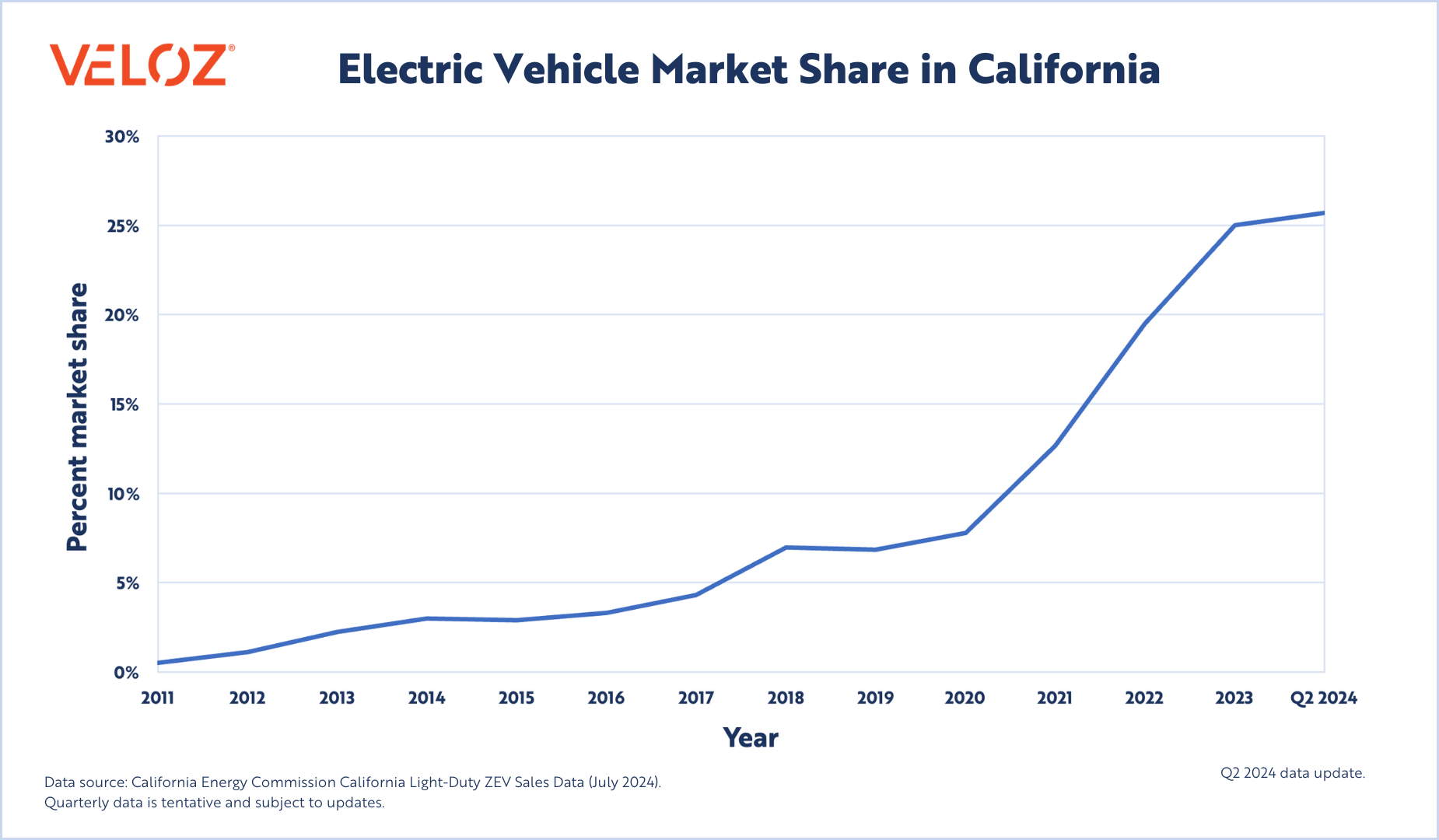

California’s Q2 2024 new EV market share stands at 25.7% — the highest Q2 sales share to date and a notable increase from the Q2 2023 market share of 24.3%. Statewide adoption has grown rapidly over the years, driven by the availability of more EV makes and models, consumer education campaigns, federal tax credits and the increased availability of charging stations throughout California.

Also, California’s commitment to expanding its EV infrastructure is evident with the recent milestone of surpassing 150,000 installed chargers across the state, including 137,648 Level 2 chargers and 14,708 fast chargers. In the first half of 2024 alone, over 24,000 new chargers were added, enhancing accessibility for EV drivers and supporting the state’s ambitious goal of making zero-emission vehicles a standard choice for all Californians. As the charging network grows, it reduces barriers to EV adoption and positions California as a leader in sustainable transportation, providing a strong foundation for continued growth in EV sales and market share.

In Q2 2024, 118,181 EVs were sold, compared to 118,776 EVs in Q2 2023 — a difference of -595 EVs — essentially maintaining sales year over year. California is on pace to reach 2 million new light-duty passenger EVs sold soon, marking a significant milestone in 2024. Globally, EV ownership continues to grow. Forecasters from the International Energy Agency predict a 20% rise in EV sales in 2024. Reports from earlier this year have also found that month-over-month light-duty EV sales in the U.S. have consistently increased for the last three years.

Veloz automaker members reported continued EV sales growth in Q2 2024. GM reported a record number of EVs sold in Q2 2024 and Ford’s EV sales rose 61% year-over-year, with the Mach-E seeing over 46% growth. BMW’s U.S. Q2 2024 EV sales increased by 24% year-over-year, while Toyota also reported very strong Q2 EV sales with a 112% increase. New models entering the market, such as the BMW i5 and Cadillac Lyriq, have further intensified competition and boosted adoption rates. Meanwhile, Hyundai and Kia have reported record-breaking sales in the first half of 2024. During Q2 2024, traditional automaker sales have helped drive overall EV sales despite a recent slight decline in Tesla’s market share.

Top 10 Selling EVs in Q2 2024:

- Tesla Model Y

- Tesla Model 3

- Hyundai IONIQ 5

- Subaru Solterra

- Toyota RAV4 Prime

- Rivian R1S

- Tesla Cybertruck

- Ford Mustang Mach-E

- Jeep Wrangler

- BMW i4

In the medium/heavy-duty EV market, CARB reports that 1 in 6 new trucks, buses, and vans sold in California were zero-emission vehicles (ZEVs) as of June 2024. The CEC also tracks medium/heavy-duty trucks, EV buses, and delivery van population annually, with the latest data updated in March 2024.

The transition to electric school buses is progressing rapidly, supported by federal funding from President Biden’s Inflation Reduction Act. As the new school year begins, California boasts 1,177 electric school buses ready to transport children according to a robust database from Veloz member World Resources Institute. California leads the nation with the highest number of operational electric school buses.

Despite concerns about EV demand, sales and the utilization of charging stations are rising, fueled by advancements in EV technology and federal programs like the Biden administration’s $5 billion NEVI program, which aims to build over 500,000 chargers across 79,000 miles of highway and roads. The market is expected to continue accelerating as more states award contracts for additional stations, addressing charging anxieties and supporting the growing number of EV owners. The rapid growth suggests that public EV chargers could outnumber gas stations within eight years, driven by a projected $6.1 billion investment in charging infrastructure this year. Retailers and gas station operators are increasingly adding chargers to attract EV drivers, with companies like Shell, Enel, and Waffle House joining the expansion.

According to the U.S. Treasury, more than 250,000 EV buyers have saved approximately $1.5 billion since January 2024 thanks to the federal tax incentives on EV sales. As the industry moves beyond early adopters to reach the early majority, the national push for improved charging infrastructure and reliability standards, streamlined incentives, tougher emissions standards, increased model availability, and EV education aimed at breaking down consumer barriers will become even more critical as the U.S. EV market continues to grow through 2024.

For media inquiries, please contact Margaret Mohr, Veloz Communications Director, at margaret.mohr@veloz.org.