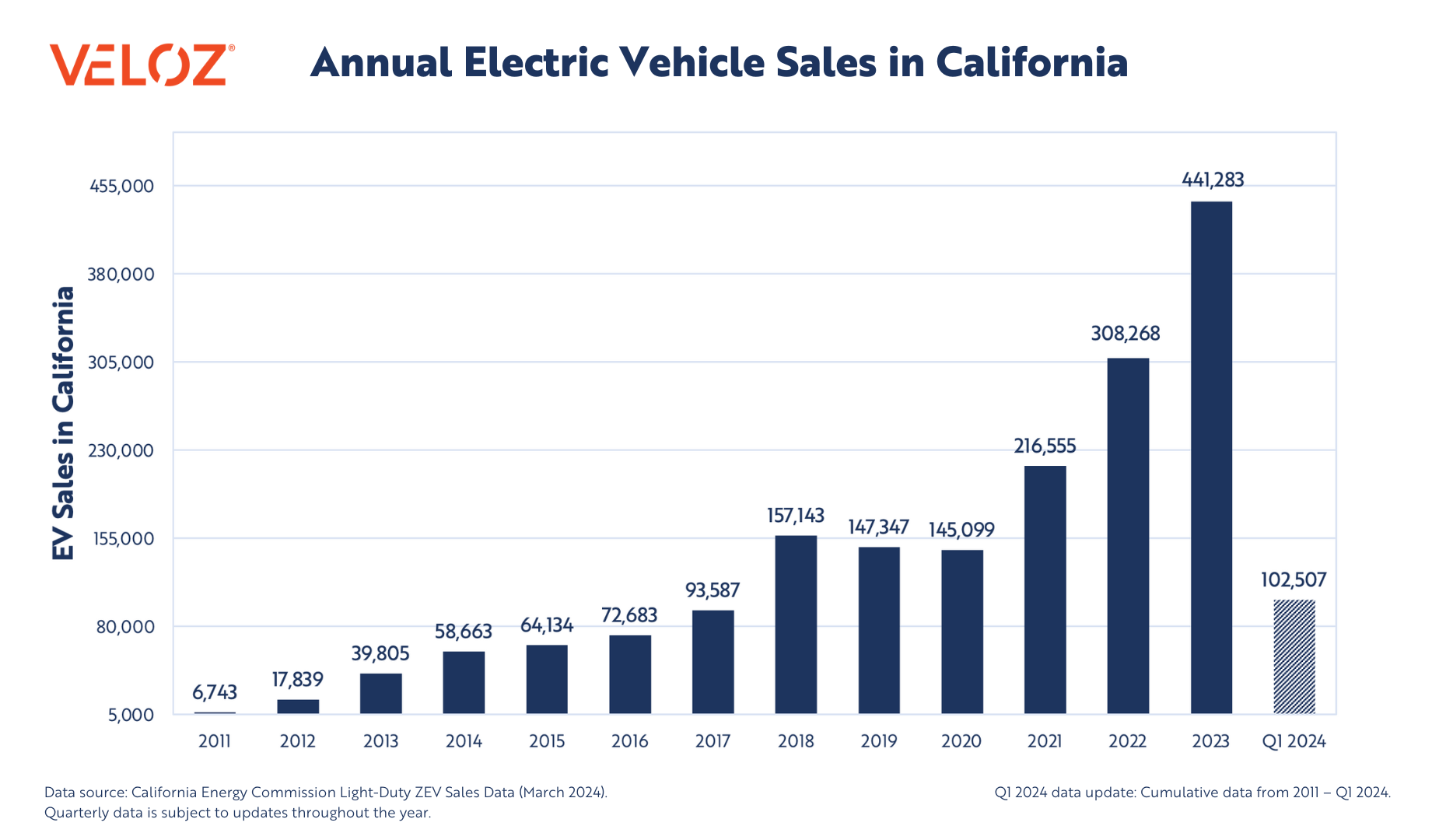

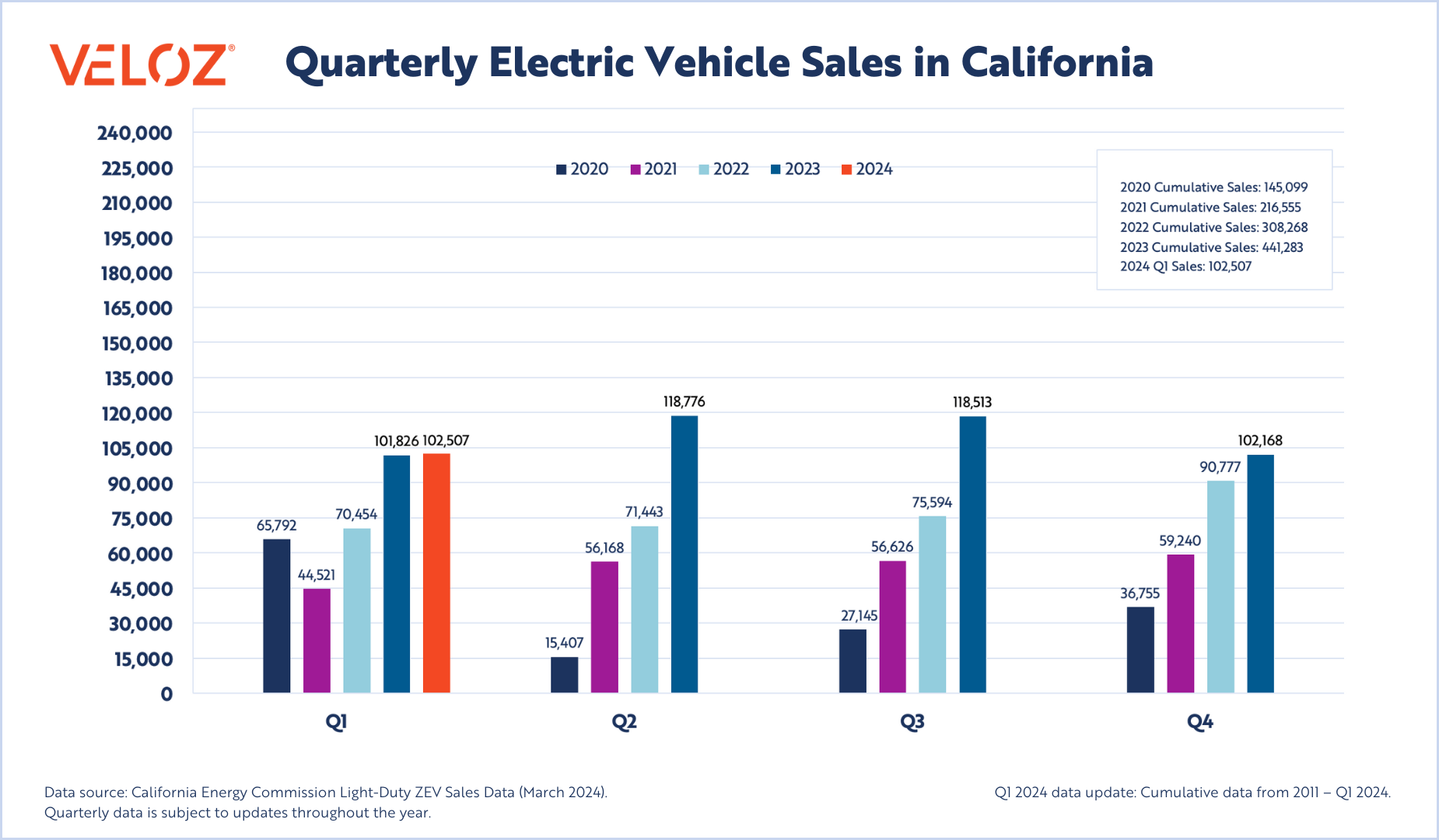

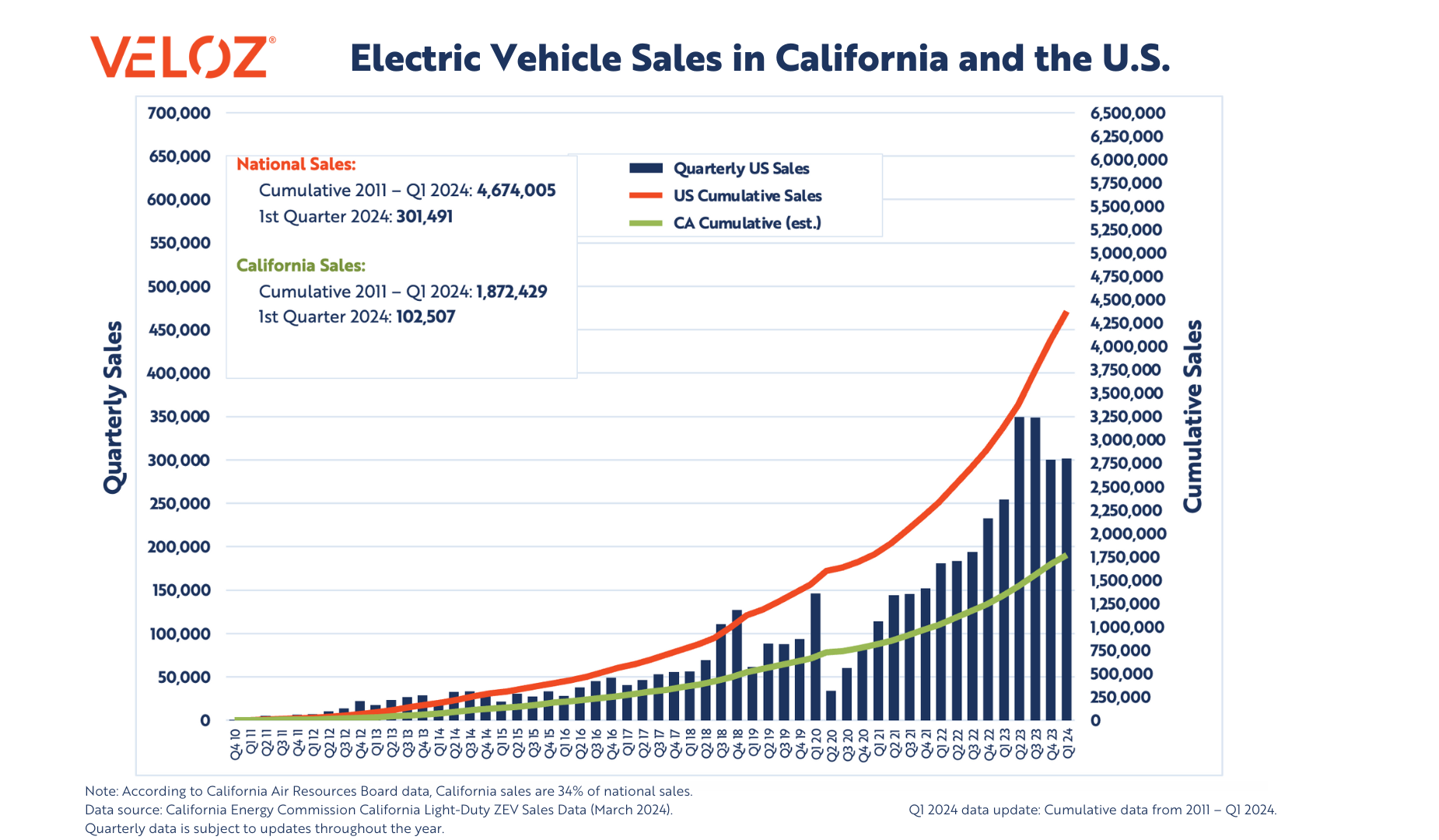

Veloz’s Q1 2024 EV Market Report is now available, and the data shows continued moderate new light-duty EV sales growth with a 0.67% year-over-year increase in Q1 sales numbers. In Q1 2024, 102,507 EVs were sold, compared to 101,826 EVs sold in Q1 2023. Additionally, the state saw 339 more EVs sold in Q1 2024 than in Q4 2023 marking a 0.33% increase and another step in the right direction toward the state’s EV goals. California is on pace to reach the 2 million new light-duty EVs sold milestone in 2024.

Globally, EV ownership continues to grow as well. Forecasters predict that EV sales will rise by 20% in 2024. Reports have also found that month-over-month light-duty EV sales in the U.S. have consistently increased for the last three years.

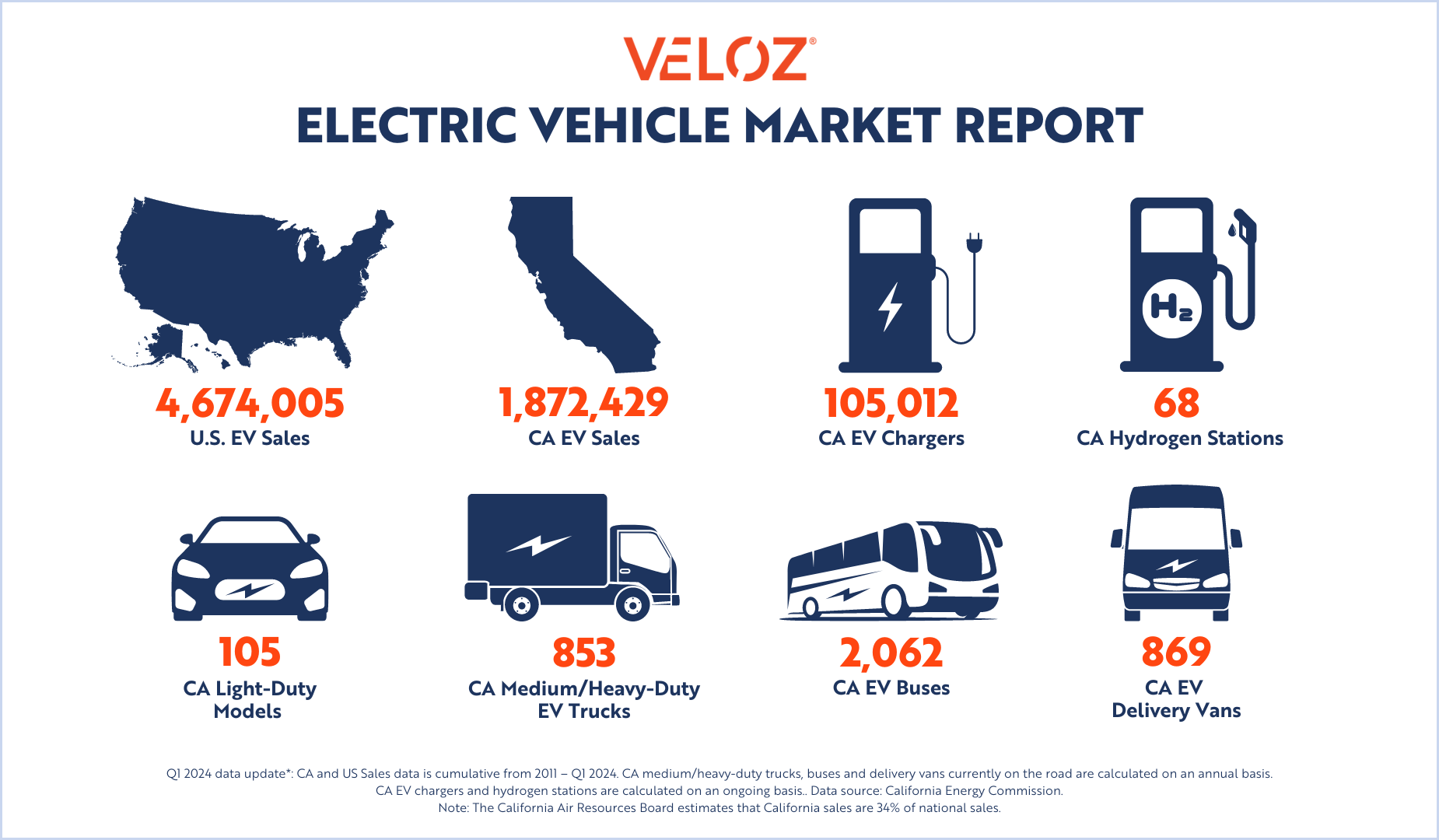

In terms of California’s medium and heavy-duty population, the state has seen a marked year-over-year increase of medium/heavy-duty trucks on the road from 272 vehicles to 853 vehicles. EV buses also saw a significant jump from 1,708 vehicles to 2,062 vehicles, while EV delivery vans on the road more than doubled, going from 340 vehicles to 869 vehicles year-over-year.

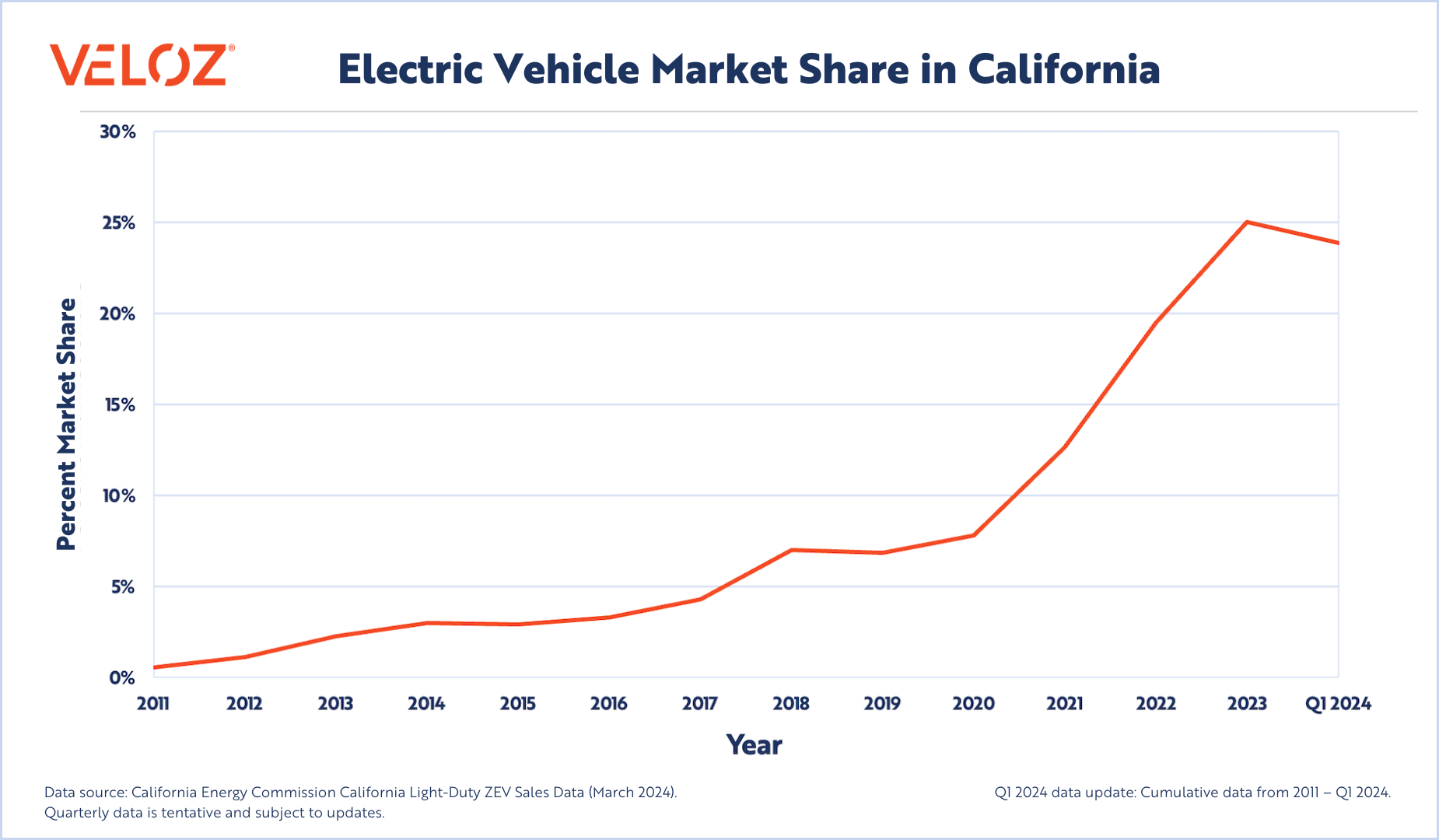

California’s Q1 2024 EV market share is 23.88% — the highest Q1 sales share to date and a steady increase compared to the Q1 2023 market share of 21.1%. State-wide adoption has seen rapid growth over the years in part due to consumer education campaigns, the tax credit-turned-upfront $7500 EV discount, and the availability of charging stations throughout California.

Veloz automaker members also continued to report EV sales growth in Q1 2024. Notably, Ford reported its EV sales were up 86% in Q1 year-over-year, with the best-selling Mach-E seeing over 400% sales growth in March year-over-year. BMW saw EV sales increase by 63% year-over-year and Toyota also reported strong Q1 EV sales — with a 74% increase year-over-year.

The national used EV market is heating up, with used EV sales hitting a record high of approximately 400,000 vehicles sold in 2023 — a number that has doubled since 2020 and is expected to continue to grow through 2024. The growth in the used EV market is attributed, in part, to new a point-of-sale rebate for up to $4000 on used EVs purchased at dealerships. Other factors include more affordable pricing and an increase of available used EV makes and models on showroom floors.

Charging has been a hot topic in both state and national news, and California has once again proven itself to be an industry leader. In March, the California’s Governor’s Office announced reaching the milestone of over 100,000 public and shared private chargers installed in the state. According to the California Energy Commission (CEC), a total of 105,012 public and private shared-use level 2 and DC fast chargers have been installed, including 31,425 in Los Angeles County, 20,143 in Santa Clara County, 8,566 in San Diego County, 6,770 in Orange County, and 2,416 in San Francisco County. Currently there is one EV charger for every five gas stations in California, which is another victory in the state’s efforts to build the biggest and most reliable charging network.

Recently, eight California metro areas landed in the top 20 EV-friendly housing markets, including San Jose-Sunnyvale-Santa Clara, San Francisco-Oakland-Berkeley, Los Angeles-Long Beach-Anaheim, San Diego-Chula Vista-Carlsbad, Sacramento-Roseville-Folsom, Oxnard-Thousand Oaks-Ventura, Riverside-San Bernardino-Ontario, and Fresno. The cities were evaluated on criteria such as the availability of EV-friendly homes and easy access to public charging facilities. In February 2024, the CEC approved a $1.9 billion EV Infrastructure Plan that will result in 40,000 new chargers statewide.

Nationally, the industry is beginning to reap the rewards of the Biden Administration’s work to build 500,000 plus chargers to connect to 79,000 miles of highway and roads through the National Electric Vehicle Infrastructure (NEVI) Formula Program. Hawaii recently announced the opening of the first NEVI-funded charging station located on Maui, following three other states — Ohio, New York and Pennsylvania — all opening NEVI-funded stations since December 2023. According to the Joint Office of Energy and Transportation, there are 33 states that have released solicitations for the NEVI program with 16 of these states already awarding contracts and installing charging stations.

As the industry moves beyond the early adopters of EV technology and now works to reach the early majority, the national push toward improved charging infrastructure and charging reliability standards, streamlined federal and state incentives, tougher emissions standards across the nation, increased make and model availability, and EV education aimed at breaking down consumer barriers will become even more critical as the U.S. EV market continues to grow through 2024.

Top 10 Selling EVs in Q1 2024:

- Tesla Model Y

- Tesla Model 3

- Tesla Model X

- Jeep Wrangler PHEV

- Hyundai IONIQ 5

- Volkswagen ID.4

- Mercedes EQE

- Toyota RAV4 Prime

- Ford Mustang Mach-E

- Dodge Hornet

For media inquiries, please contact Jennifer Newman, Veloz Communications Director, at Jennifer.Newman@Veloz.org.