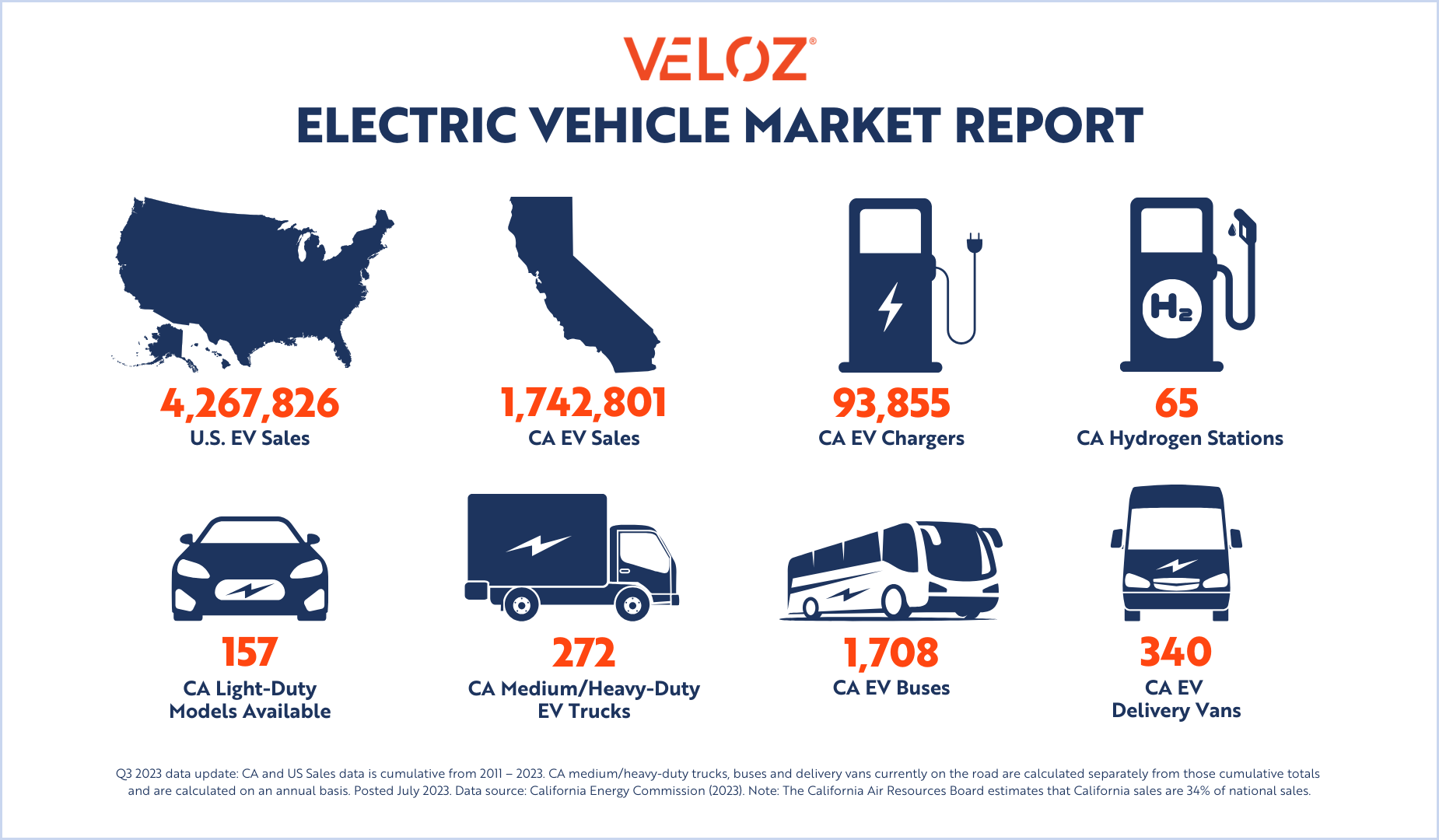

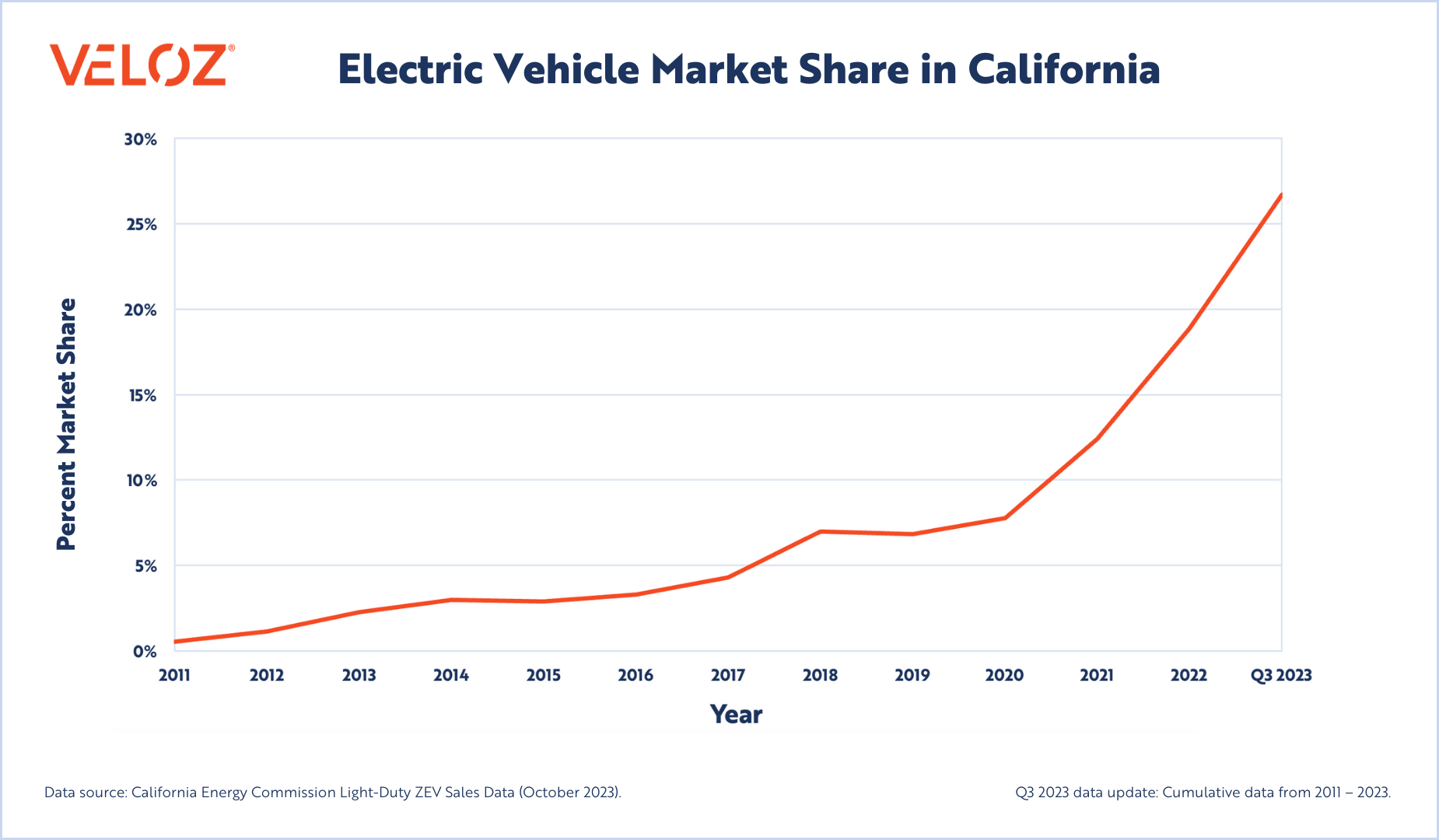

Veloz’s Q3 EV Market Report is now available and shows a substantial year-over-year increase in EV market share in California, with 26.75% of new cars sold being ZEVs as compared to 17.7% of new car sales in Q3 of 2022. This news comes on the heels of a slew of zero emissions announcements in the state. In September, California reached its goal of installing over 10,000 fast chargers more than a year ahead of schedule. With trucks being a top contributor to the state’s transportation-related emissions, California made additional strides towards a zero emissions future in October when the state hit its ZEV truck sales goal two years ahead of schedule.

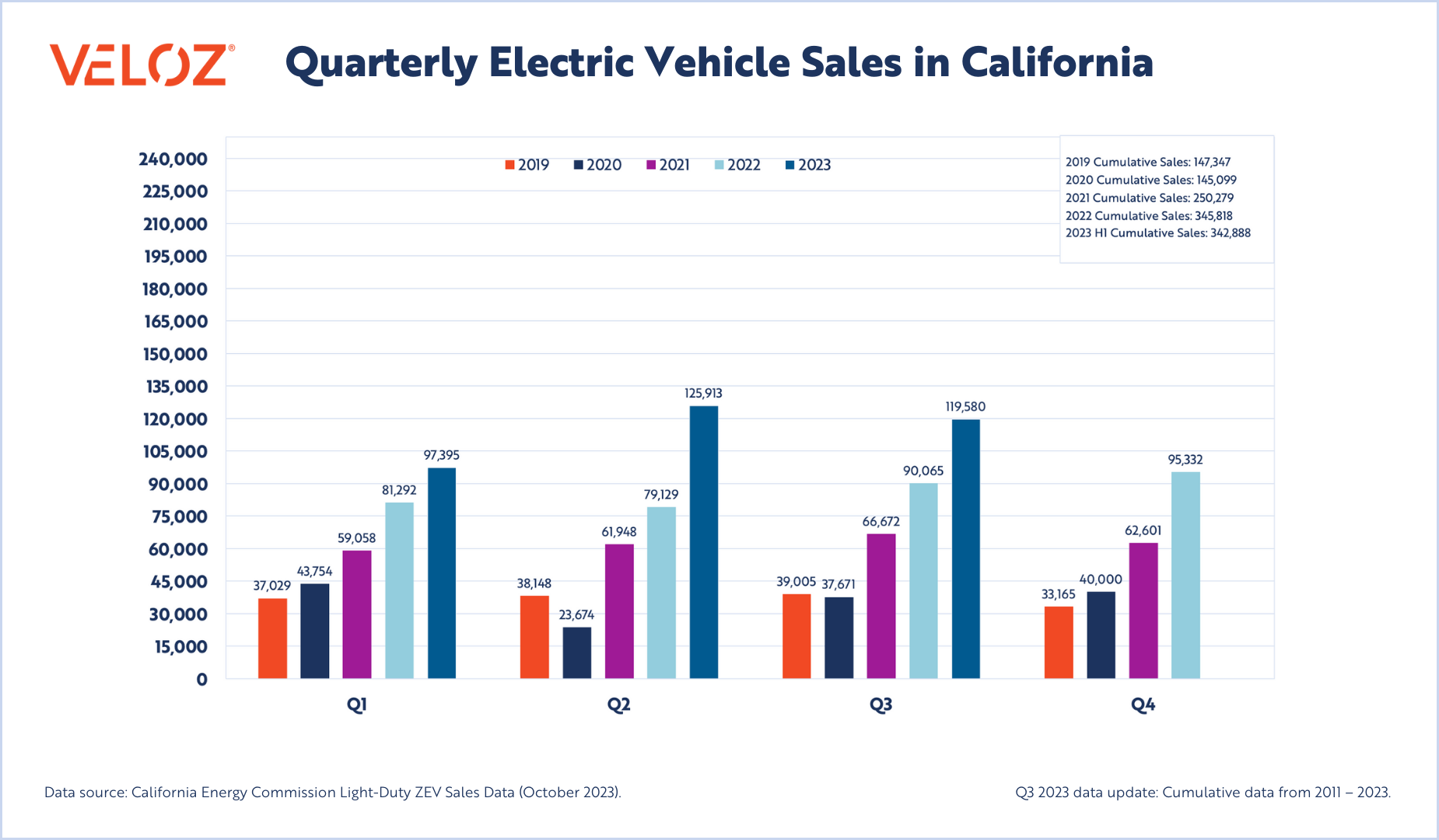

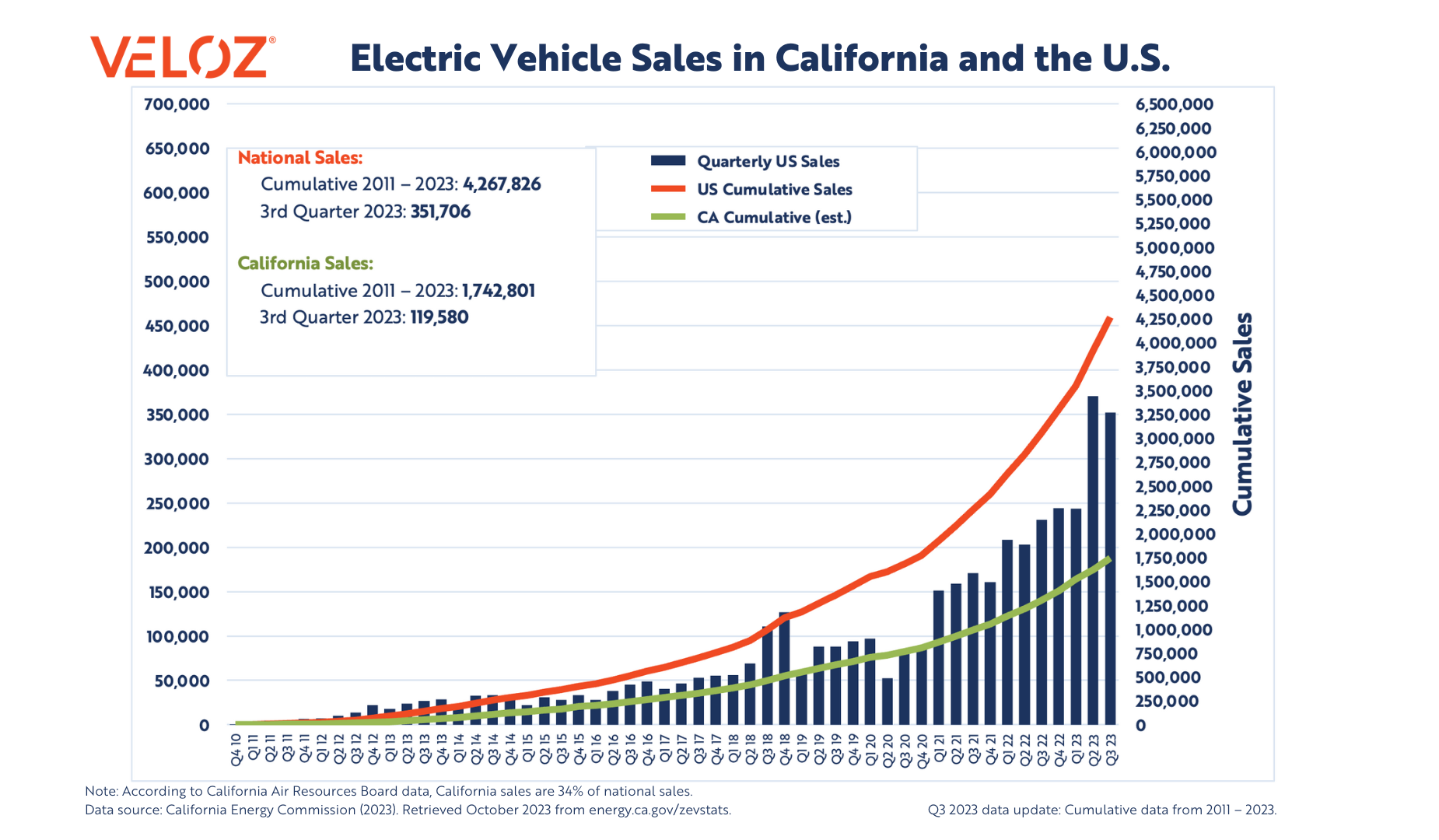

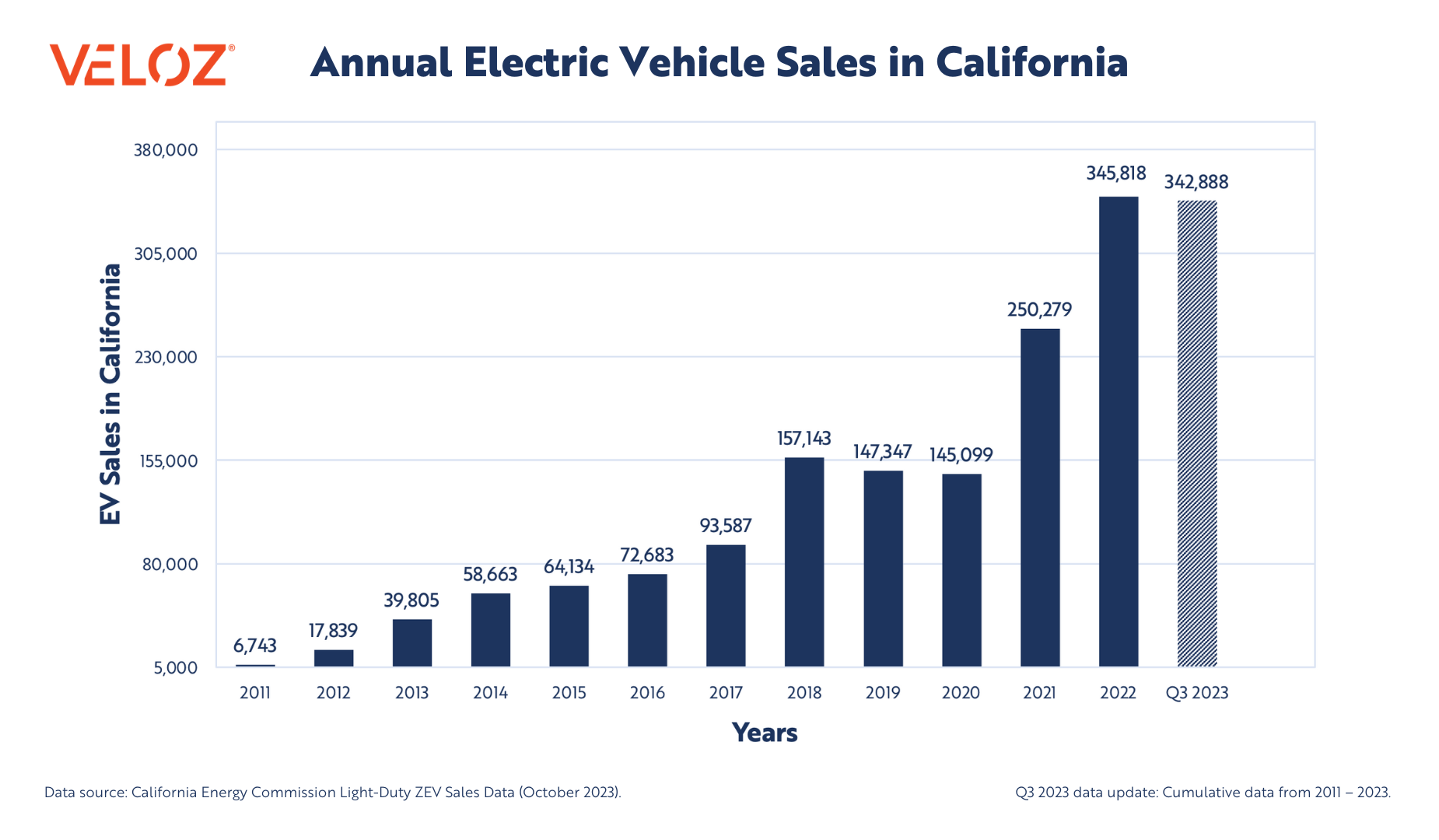

As a result of the state’s push to ensure that passenger vehicle sales are zero-emission by 2035, California’s EV sales continue to rise year-over-year. The Q3 data shows 119,580 California EV sales, which is the highest Q3 EV sales number to date. Year-over-year, California’s Q3 EV sales saw nearly a 33% increase, with 29,515 more EVs sold this quarter compared to Q3 2022. Although Q3 sales dipped slightly from Q2 2023, California is still set to beat its 2022 record-high 345,818 annual EV sales by the end of 2023. With a greater number of EVs comes an increased need for charging infrastructure and the state recently announced plans to distribute $40.5 million in federal funding for 270 additional fast chargers along various California highways. The funds are from the Infrastructure Investment and Jobs Act (IIJA) and the National Electric Vehicle Infrastructure (NEVI) program focused on boosting EV travel throughout the country by creating a coast-to-coast network of EV fast chargers.

Nationally, the data shows that the country continues to adopt EVs at a robust rate, with estimated U.S. EV sales totaling over 4.2 million. In October, it was reported that electric vehicles are seeing the highest discounts yet, benefitting consumers who are ready to make their next vehicle purchase electric. We anticipate U.S. market growth to continue due to ongoing cost-cutting measures taken by automakers, increased charging infrastructure across the nation, and the shift of the federal EV tax credit to a point-of-sale dealership rebate in 2024. This encouraging Q3 data reflects the national push toward improved charging infrastructure, federal and state incentives, tougher emissions standards, increased make and model availability and EV education that continues to break down consumer barriers, resulting in the exponential growth of EV adoption.

Top 10 Selling EVs in Q3 2023:

- Tesla Model Y

- Tesla Model 3

- Jeep Wrangler PHEV

- Chevrolet Bolt EUV

- Volkswagen ID.4

- Ford Mustang Mach-E

- BMW i4

- Hyundai IONIQ

- Tesla Model X

- Chevrolet Bolt EV